When it comes to growing your wealth, understanding how interest works is crucial. Whether you’re saving money in a bank account or investing in other financial instruments, the way interest is calculated has a direct impact on your financial growth. Two common types of interest are simple interest and compound interest. In particular, daily compound interest often stands out as a more dynamic method that accelerates your investment growth. In this article, we’ll explore the key differences between these two types of interest, their pros and cons, and how tools like a daily compound interest calculator can help you make informed decisions.

What Is Simple Interest?

Simple interest is the straightforward calculation of interest based on the principal amount. The formula for simple interest is:

Simple Interest = Principal × Rate × Time

This simplicity is its main appeal, as it is easy to calculate and understand. For instance, if you invest ₹1,000 for three years at a 5% annual interest rate, you’ll earn ₹150 per year in interest, resulting in a total interest of ₹450 over three years.

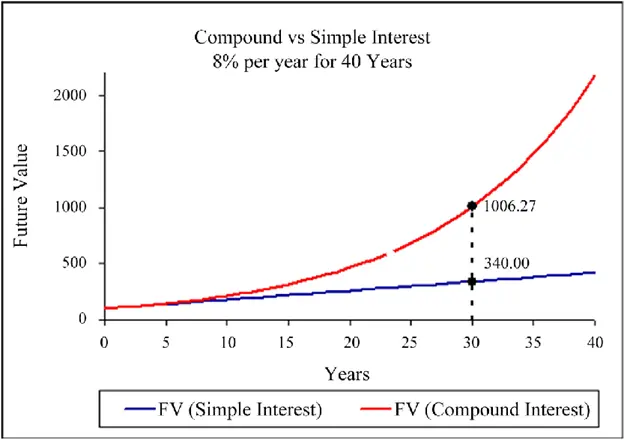

The key feature of simple interest is that it doesn’t account for any growth in interest over time. Unlike compound interest, the amount earned remains fixed every period, since no “interest on interest” occurs.

What Is Daily Compound Interest?

Compound interest, on the other hand, calculates interest not just on the principal, but also on accrued interest over time. When compounded daily, this mechanism amplifies the growth rate of your money because the interest is added to the principal every single day, resulting in exponential growth.

Daily compound interest is calculated using the formula:

A = P × (1 + r/n)^(n × t)

Where:

- A = Final amount

- P = Principal

- r = Annual interest rate

- n = Number of compounding periods in a year

- t = Number of years

Using tools like a daily compound interest calculator makes it easier to see how even small daily increments build over time. For example, if you invest the same ₹1,000 at a 5% rate, compounded daily, after 3 years, you’ll end up with approximately ₹1,157.63, earning ₹157.63 in interest — nearly ₹50 more than with simple interest.

Key Differences Between Simple Interest and Daily Compound Interest

1. Growth Rate

Simple interest grows at a linear rate, while daily compound interest grows exponentially. With simple interest, you’ll earn the same amount each year. Compound interest, on the other hand, accelerates earnings as the interest accumulates daily, creating a snowball effect.

2. Time Factor

Time plays a significant role in compound interest growth. The longer the time horizon, the greater the gap between the returns from simple interest and daily compound interest. If you plan to save or invest for the long term, daily compound interest can lead to significantly higher returns.

3. Complexity

Simple interest calculations are easier to manage because the formula involves fewer variables. Compound interest calculations, especially when compounded daily, involve more complexity. However, online tools like a daily compound interest calculator simplify the process, making it accessible for everyone.

4. Use Case

Simple interest is often used for short-term loans, certain savings vehicles, or when you need predictable returns over a defined period. Daily compound interest, meanwhile, is ideal for investments like savings accounts, mutual funds, or long-term financial goals where growth over time is the priority.

How Daily Compound Interest Calculator Can Help

Calculating daily compound interest manually can be a daunting task, especially if you’re unfamiliar with the math behind it. Fortunately, there are daily compound interest calculators available online that do the heavy lifting for you. These calculators are user-friendly and allow you to enter variables like the principal, interest rate, time, and compounding frequency to see your projected returns.

Such tools make it easy to compare scenarios and choose the most effective option for your financial goals. Whether you’re saving for a down payment on a house or planning your retirement, daily compound interest calculators help you optimize your savings strategy.

Pros and Cons of Simple Interest

Pros:

- Easy to calculate and understand

- Predictable returns over a specific period

- Suitable for short-term financial goals

Cons:

- Doesn’t leverage the power of interest compounding

- Less effective for long-term growth

Pros and Cons of Daily Compound Interest

Pros:

- Offers exponential growth over time

- Maximizes your returns, especially for long-term investments

- Benefit increases with higher frequency of compounding

Cons:

- More complex to calculate manually

- May require financial tools for projections and comparisons

Simple Interest vs Daily Compound Interest: Which Is Better?

The choice between simple interest and daily compound interest ultimately depends on your financial goals and the time frame of your investment or savings. For short-term needs or fixed-rate loans, simple interest may suffice. However, if you’re aiming to grow your money faster and maximize your returns over the long term, it’s hard to beat the power of daily compound interest.

Conclusion: Choose the Right Tool for Your Financial Journey

Whether you’re paying off a loan or building wealth for future goals, knowing the difference between simple interest and compound interest is crucial. While simple interest offers stability, daily compound interest unlocks exponential growth. Using resources like a daily compound interest calculator can further empower your financial decisions.

Ultimately, understanding how these mechanisms work ensures that you’re equipped to make choices that align with your unique financial objectives, helping you maximize the growth of your money.